Financial Well-Being (Stop ignoring this)

How Financially fit are you?

Let’s talk MONEY!

It’s the thing that apparently makes the world go around. If you want to live a good life… you must have a lot… right?

WRONG!

Do you feel uncomfortable when money is mentioned

Whether you get asked “how much do you earn”, or you are waiting on a price for something?

The truth is money & sex seem to be taboo topics of conversation for most.

In this week’s newsletter I want to provide a new understanding for you and share what I have personally done. Not for financial advice. I just wish more people shared things they did when I was stuck so I could start doing my own research to see what may work for me.

The key. If you take responsibility and start invest 15 minutes a day into learning… you can remove financial stress from your life. I will attach some helpful books at the end.

We will discuss:

Levels of financial freedom.

Why people avoid money

Financial basics

I used to dislike money because I HAD NONE

I would tell myself:

People with money rip others off

Money doesn’t buy happiness

People with money lose family

What I realised was money is just a resource… like food, water or a car.

It can serve needs but it’s value comes through what I can do with it.

I still remember the day I committed to making money. I had this shift that I WANTED a great life and that I DESERVED it.

I still had no idea of how much or what I would do with it.

$1,000,000 seemed like a good number

I was just sick and tired of struggling

It was this decision that changed everything. What I am about to share was what I wish I knew.

Money is a resource… it allows you to exchange it for what you value

Some men feel the need to make lots, others are happy with little

There is no right or wrong.

It’s about knowing what YOU WANT

It doesn’t need to be complicated. As with everything in life I like to find a framework that provides direction and clarity for what I can focus on.

Then I adapt along the way to make it suit my needs.

Here are a few financial checkpoints I stumbled across.

After I found the checkpoints above I recognised pretty quickly that I didn’t need $1,000,000 to live a great life.

I looked at the list and one specifically jumped out at me FINANCIAL INDEPENDENCE.

I love the idea of having my money work for me so that I have CHOICE. If I wanted to be a stay at home dad I could do that without financial stress.

Yours may be different and that is OK.

We are all different and there is know right or wrong. You work to what you want.

Every decision requires sacrifice

You must make your decision and be comfortable with what is to come.

If you’re like I was… you are bound to have some poor beliefs around yourself and money.

False money beliefs:

I don’t have time

I don’t have money to invest

I have to many expenses

What if I lose money

Money will make me evil

If this crosses your mind. You don’t have a money problem… you have a MINDSET problem.

Read last week’s newsletter for more on mindset

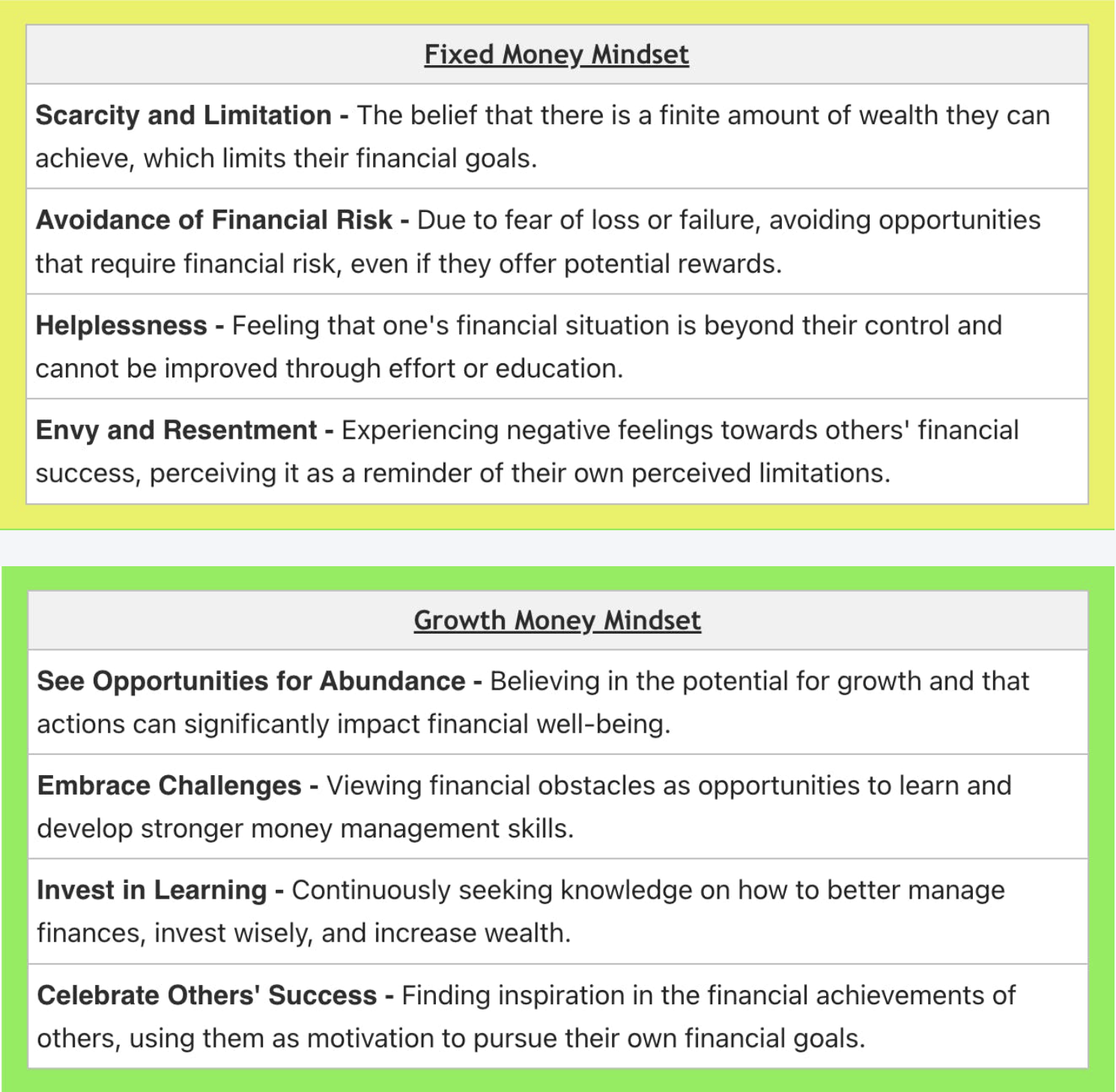

To the point of mindset.

You must have a GROWTH mindset.

This means you believe you can learn or acquire anything you desire.

The truth is…

You won’t always have time.

You won’t always have the money to invest

You will lose money

That is why most men remain stuck.

If you want a different outcome, you need new inputs

There will never be a perfect time.

When you view creating wealth with a growth mindset you understand the best action is to… start.

This will highlight what you ACTUALLY know about money & what you need to LEARN.

Things you need to differentiate….

Working on having a growth mindset especially with money opens you up to more opportunity.

It doesn’t take away the work that will need to be done. You approach will change though.

My initial thoughts is -

Can you imagine a life without financial stress

It is possible for all of us.

But there is a price.

That is why I believe in getting clear on what checkpoint suits you and the life you want.

From there you can get clear on what your number is to achieve that.

Don’t make it complicated. There are podcasts, books and financial advisors who can help you set up a road map.

From there you will have action steps to take to move towards your financial goals.

I rarely talk about money within The Man That Can Project but it’s something have been upskilling in for years. I own an invest property, crypto, stocks and 2 businesses.

I have made plenty of mistakes, lost thousands of dollars but I am learning.

I know my $ number to live a great life and I have a plan to get there.

I will continue to share what I learn on this as taking control of my financial future has allowed me to grow in other areas of my life.

Some key areas to start learning about are:

Planning - Budgeting, Financial goal setting & risk management

Saving - Emergency fund, short-term goals

Investing - Asset allocation, Compounding

Be patient and just invest 15-30 minutes a day into learning about everything discussed above.

There is no reason why you can’t take control of your finances.

Thanks for reading this week. Make sure you subscribe to get the weekly newsletter.

A great episode on my podcast that helped me was:

Book recommendations:

Barefoot Investor - Purchase Now

Rich Dad, Poor Dad - Purchase Now

The Psychology Of Money - Purchase Now

See you next week